Atlanta REALTORS® Association (ARA), the largest association of its kind in Georgia, released its June 2022 Market Brief on residential housing statistics for 11 area counties in metropolitan Atlanta. The Market Brief, compiled by First Multiple Listing Service (FMLS), provides the only regionally-focused synopsis of monthly sales and home prices for single-family residential properties.

The June 2022 Market Brief, compiled by First Multiple Listing Service (FMLS), provides a regionally focused synopsis of monthly sales and home prices for residential properties in Metro Atlanta. This summary covers 11 counties: Cherokee, Clayton, Cobb, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Paulding, and Rockdale.

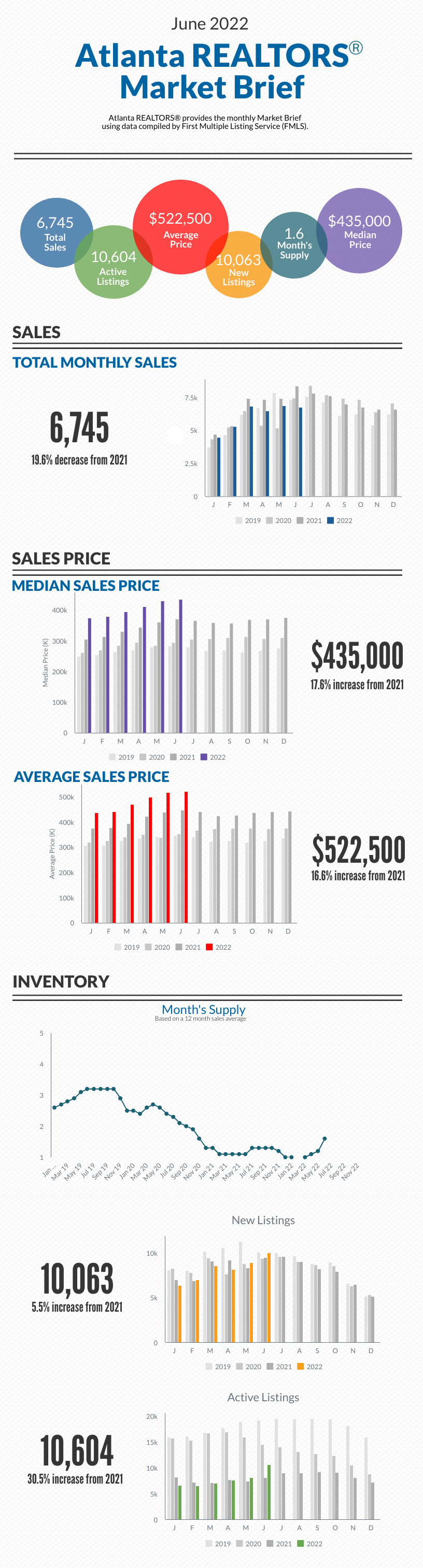

Demand: June residential sales were at 6,745, a decrease of 19.6% from the previous year.

Price: Average and median sales prices continue to outpace 2021’s figures, with positive gains. The median sales price in June was $435,000, an increase of 17.6% from last June. The average sales price was $522,500, up 16.6% from the previous year.

Supply: Atlanta area housing inventory totaled 10,604 units in June, an increase of 30.5% from June 2021. New listings totaled 10,063, up 5.5% from June 2021 and up 12.3% from the previous month. The month’s supply over a 12-month period increased to 1.6 months.

A Word from 2022 Atlanta REALTORS® President Karen Hatcher:

“Rising interest rates have decreased the numbers of buyers on the market, however sales in Metro Atlanta still remain strong with listings averaging only 6 days on market leading into the summer season,” reports Atlanta REALTORS® Association President Karen Hatcher.

“We are still experiencing double-digit increases in the Median Price, but the increases are expected to begin to slow in the future due to rising interest rates,” says Hatcher. “The demand is still strong so we expect to continue to have buyers who can afford to purchase fueling the market.”

“It’s exciting to see the number of new project starts and opportunities in our growing market! Buyers affected by the rising interest rates should look at home purchase options with a new lens. Consider homes with less square footage, or may be a little older home and in need of some cosmetic upgrades. This could still get you in your dream neighborhood and give you an opportunity to put your own spin on it over time. Partner with a REALTOR® to help you navigate this market and find a home that works for you.” stated Hatcher.